wisconsin car sales tax calculator

The average Wisconsin car sales tax including state and county rates is 5481. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due.

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to factor in state taxes titling and registration fees vehicle inspectionsmog test costs and car insurance into your total cost.

. You can calculate the sales tax in Wisconsin by multiplying the final purchase price by 05. This tool will help you calculate the fees that Wisconsin drivers pay each year compared to drivers in other Midwest states. Enter the 9-digit zip code Zip4.

Title Fees Title fees for a standard automobile in Wisconsin cost 16450 for the original title or title transfer. 425 Motor Vehicle Document Fee. London borough of barking and dagenham accounts payable.

The estimated tax and registration combined is 2589 but this may vary based on your location. For example lets say that you want to purchase a new car for 60000 you would use the following formula to calculate the sales tax. Wisconsin rate and boundary database files can be used with your system.

Mary berry apple and rhubarb pie. 775 for vehicle over 50000. In Wisconsin the state sales tax rate of 5 applies to all car sales.

Our required dealer documentation fee is 249. Unit 7 progress check mcq ap lit. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles.

Well review the vehicle property tax for each state in the table below. Instructions Enter the date of the transaction. You will need to select a personal motor vehicle mo st like your vehicle from a list of popular models.

Entering a 5-digit zip code may result in more than one taxing jurisdiction. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. You may also be interested in printing a Wisconsin sales tax table for easy calculation of sales taxes when you cant access this calculator.

The statewide sales tax in Wisconsin is 5. Adjust quote numbers in calculator. Dozens of vehicles are included and we.

60000 x05 3000. You must determine the proper taxing jurisdiction. Before-tax price sale tax rate and final or after-tax price.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Wisconsin local counties cities and special taxation districts. Mortgage Loan Auto Loan Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage Payoff Income Tax Compound Interest. How to Calculate Wisconsin Sales Tax on a Car.

Car tax as listed. The sales tax charged on car purchases in Wisconsin is 5 so you can expect to pay at least 5 of the total vehicle price for the tax fee. You can calculate the sales tax in Wisconsin by multiplying the final purchase price by 05.

2000 x 5 100. Program of nmop that promotes arts from the regions. Our free online Wisconsin sales tax calculator calculates exact sales tax by state county city or ZIP code.

635 for vehicle 50k or less. MAXIMUM LOCAL COUNTY RATES. The total tax rate also depends on your county and local taxes which can be as high as 675.

The sales tax charged on car purchases in Wisconsin is 5 so you can expect to pay at least 5 of the total vehicle price for the tax fee. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. You can use our Wisconsin sales tax calculator to determine the applicable sales tax for any location in Wisconsin by entering the zip code in which the purchase takes place.

In addition there may be county taxes of up to 05 along with a stadium tax of up to 01. WisDOT Office of Public Affairs 608 266-3581 opaexecdotwigov. Wisconsin car tax is 227145 at 550 based on an amount of 41299 combined from the sale price of 39750 plus the doc fee.

If for example you pay a 10 sales tax on 20000 thats an additional 2000 you must spend. Motorists can find the Midwest Driver Fee Calculator on the WisDOT website. Vehicle Registration Tax Calculator.

This calculator can help you estimate the taxes required when purchasing a new or used vehicle. While the calculator contains a number of models and years it is not yet comprehensive. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Individual costs will vary based on conditions and driving habits. Consumer Notes The documentation fee is determined by the dealer but is not negotiable so clarify upfront what the dealer charges. The combined rate used in this calculator 55 is the result of the Wisconsin state rate 5 the 53955s county rate 05.

For more information contact.

States With Highest And Lowest Sales Tax Rates

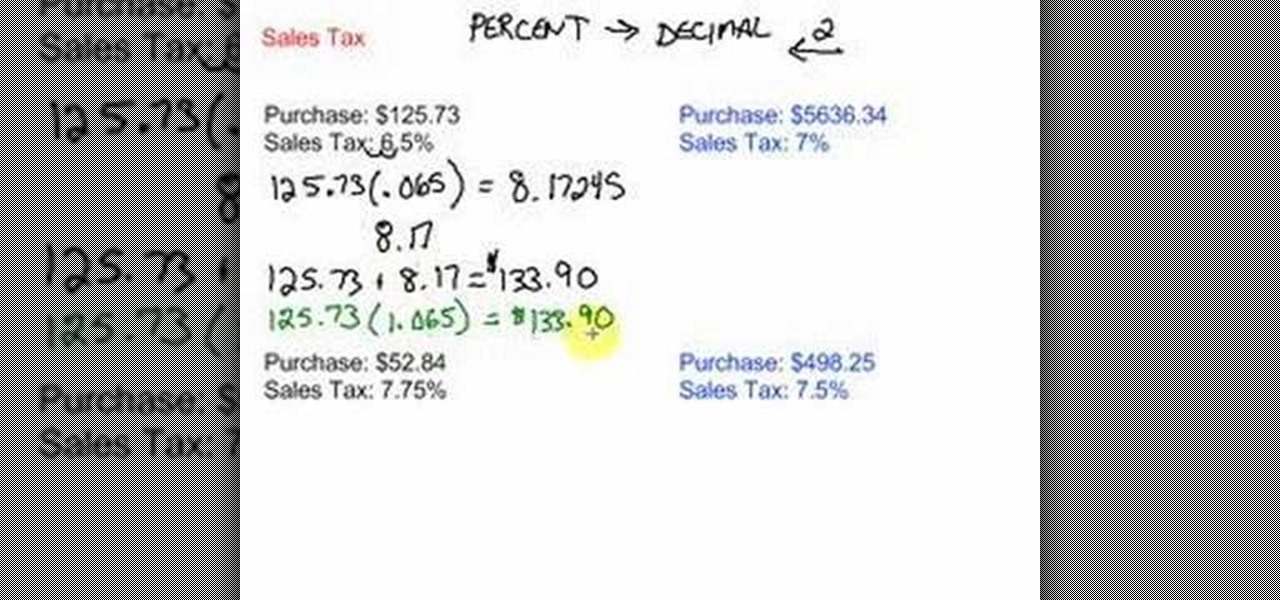

How To Figure Out And Calculate Sales Tax Math Wonderhowto

Sales Tax By State Is Saas Taxable Taxjar

How To Figure Out And Calculate Sales Tax Math Wonderhowto

How To Calculate Sales Tax For Your Online Store

Wisconsin Sales Tax Small Business Guide Truic

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Sales Tax Definition Formula Example

Which Are The Most Tax Friendly States For Retirees 2020 Newretirement

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation